Gambling Winnings And Losses On 1040

Author

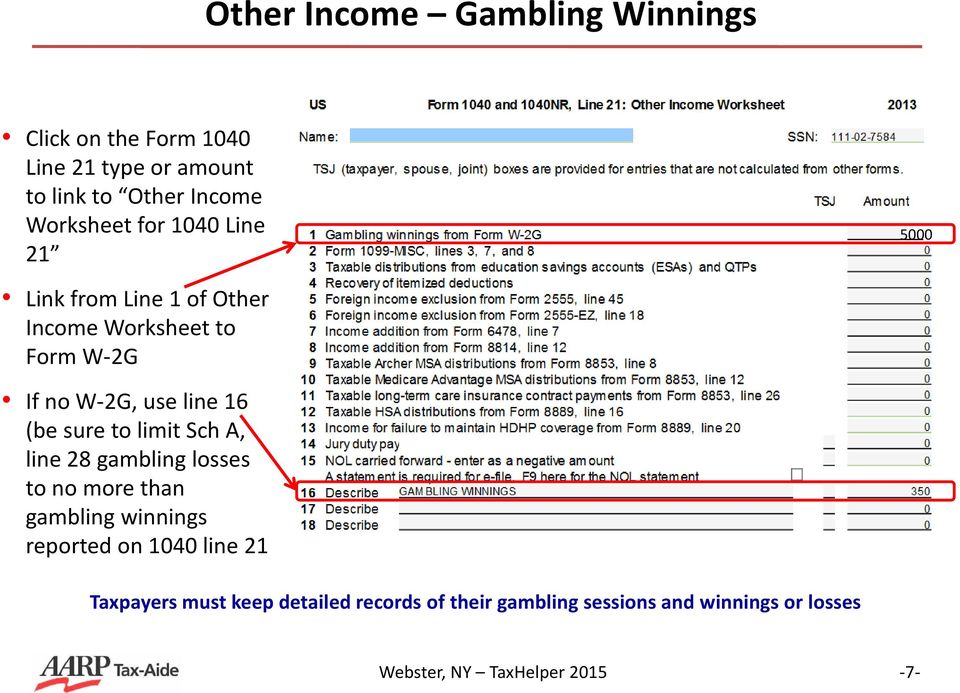

Gambling Losses up to the Amount of Gambling Winnings You must report the full amount of your gambling winnings for the year on Schedule 1 (Form 1040), line 21. You deduct your gambling losses for the year on Schedule A (Form 1040), line 16. You can't deduct gambling losses that are more than your winnings. You can't reduce your gambling winnings. On his federal return, he must report $2,000 of gambling winnings and gambling losses of $2,000 (again, the itemized deduction for gambling losses is limited to gambling winnings). On his Michigan return, he only reports the Friday daily winnings of $2,000. It is CRITICAL that gambling winnings and losses be properly documented.

Do you roll the dice? Enjoy the slot machines? Even as a casual gambler, your winnings are fully taxable and must be reported on your tax return. Learn more about how the Tax Cuts and Jobs Act impacts gambling.

There are unique considerations when it comes to disclosing gambling wins and losses on your tax return….modified recently under the Tax Cuts and Jobs Act (TCJA). If you gamble, make sure you understand the tax consequences.

First off—what counts as gambling in the eyes of the IRS?

Gambling income includes (but is not limited to)

- Winnings from

- Lotteries

- Raffles

- Horse races

- Casinos

- Cash winnings

- Fair market value of prizes (like cars and trips)

The general rules

Wins

You are required to report 100% of gambling winnings as taxable income on your 1040. In addition, all complimentary offerings provided by casinos and gambling establishments must also be included in winnings. Winnings are subject to your federal income tax rate (though rates have been reduced under the TCJA-check out our blog, 2018 Tax Reform Provisions for Individuals for more on this).

Also, if you receive a certain amount of gambling winnings or if you have any winnings that are subject to federal tax withholding, the payer must issue you a Form W-2G “Certain Gambling Winnings”.

In other words, the payer is required to issue you a W-2 G if you receive (according to the IRS).

- $1,200 or more in gambling winnings from bingo or slot machines;

- $1,500 or more in proceeds (the amount of winnings minus the amount of the wager) from keno (a game of chance similar to lotto);

- More than $5,000 in winnings (reduced by the wager or buy-in) from a poker tournament;

- $600 or more in gambling winnings (except winnings from bingo, keno, slot machines, and poker tournaments) and the payout is at least 300 times the amount of the wager; or

- Any other gambling winnings subject to federal income tax withholding.

Losses

Gambling losses can be written off as miscellaneous itemized deductions. The gambling loss deduction is limited to the extent of your winnings for the year and excess losses cannot be carried forward to future years.

Under the TCJA, misc. deductions subject to the 2% of adjusted gross income floor are not allowed, however certain deductions (including the gambling loss deduction) are still deductible.

However, since the standard deduction for 2018 was nearly doubled by the TCJA, many taxpayers may no longer benefit from itemizing, seeing as itemizing saves tax only when the total itemized deductions exceed the applicable standard deduction.

How do you claim a deduction for gambling losses?

Recordkeeping is key!

To deduct gambling losses, you must document:

- The date and type of gambling activity

- The name and address of the gambling establishment

- The names of anyone who was present with you at the gambling establishment

- The amount won or lost

**You can document gambling on table games by recording the number of the table you played and retain statements showing casino credit issued to you. As far as lotteries go, you can use winning statements and unredeemed tickets as documentation.

Key takeaway

The TCJA adds limitations to the gambling loss deduction — you can now only deduct losses up to the amount of your winnings. Any excess loss cannot offset other highly taxed income. Thus, those in the trade or business of gambling, may no longer deduct non-wagering expenses, such as travel expenses or fees, to the extent those expenses exceed gambling gains.

Questions? Contact us.

The TCJA…So Many Changes, So Many Questions…we can help you navigate this huge tax overhaul! Visit our Tax Reform Center for everything you and your business need to know, now.

Newsletter

Get KLR updates delivered to your inbox.

SubscribeArticles By Topic

Global Tax Mission Matters Business The Restaurateur Paycheck Protection Program (PPP)Gambling income, unsurprisingly, is subject to income tax. This post is an overview of federal and Michigan treatment of gambling income and losses.

FEDERAL TAX TREATMENT OF GAMBLING INCOME & LOSSES

On your federal income tax return, you can take an itemized deduction for gambling losses, but only to the extent of gambling income (in other words you can’t claim an overall loss on gambling activity).

Example: John likes to play blackjack and had winnings of $40,000 in 2009. He also lost $90,000 in the same year. John has to report his $40,000 winnings as income, but he can only deduct $40,000 of his gambling losses because gambling losses are limited to gambling winnings. Excess gambling losses cannot be carried forward.

It should be noted that taxpayers must itemize to claim gambling losses.

Example: Joan won $4,000 in the lotto in 2009. She also lost $5,500 in other gambling activity during the year. If she does not itemize, she has to claim the $4,000 in income and cannot deduct the $5,500 in gambling losses—not a good result.

Even though the itemized deduction for gambling losses can offset gambling income, it is a below-the-line deduction (i.e., it is taken after computing AGI). AGI is used to calculate various phaseouts for credits and deductions. Therefore, gambling income may affect your phaseouts even though they are offset by gambling losses.

MICHIGAN TAX TREATMENT OF GAMBLING INCOME & LOSSES

In Michigan, gambling income is based on the amount of gambling winnings included in federal AGI (the bottom line of the first page of your Form 1040) without taking into account the itemized deduction for gambling losses. So, in the above examples, John has $40,000 in gambling income on his MI-1040 and pays $1,700 in tax and Joan has $4,000 in gambling income on her MI-1040 and pays $170 in tax even though both John and Joan had overall gambling losses.

Gambling Winnings And Losses On 1040 2019

To get around this unlucky result, the strategy is to use gambling losses to directly offset gambling income, rather than take gambling losses as an itemized deduction. There are two ways to do this:

* Special Rule for Slots and other Casual Gambling

* Becoming a professional gambler (harder than you think and will not be discussed here)

SPECIAL RULE FOR SLOTS AND OTHER CASUAL GAMBLING

Generally, gambling winnings and losses have to be determined on a wager-by-wager basis. For causal gambling (slots, poker, blackjack, horse racing, etc.) you can determine gambling winnings and losses on a net daily basis. By figuring gambling income on a daily basis (rather than wager-by-wager) gambling winnings are directly offset by gambling losses (and thus become excludable from Michigan income tax).

Example (wager-by-wager basis): Jimmy goes to the casino on Friday and buys $1,000 in tokens to play slots. He has $9,000 in winning spins and $6,000 in losing spins. He cashes out on Friday with $3,000. Jimmy wants to continue his winning streak on Saturday. He buys $4,000 in tokens. This time Jimmy has $1,000 in winning spins and $5,000 in losing spins. He leaves the casino with nothing.

On a wager-by-wager basis, Jimmy has $10,000 in winning spins over the two days and reports this amount as income. Jimmy has $11,000 in losing spins over the two days and deducts his losses as an itemized deduction (limited to the $10,000 in gambling winning). However, on Jimmy’s Michigan tax return, he must report the $10,000 as income, but cannot take a deduction for gambling losses.

Same Example (daily basis): Jimmy’s daily gambling winnings and losses are netted. Jimmy has overall income of $2,000 on Friday (Cash Out: $3,000 & Cash In: $1,000) and an overall loss of $4,000 on Saturday (Cash Out: $0 & Cash In: $4,000). On a daily basis, Jimmy had $2,000 of gambling winnings on Friday and $4,000 of gambling losses on Saturday. On his federal return, he must report $2,000 of gambling winnings and gambling losses of $2,000 (again, the itemized deduction for gambling losses is limited to gambling winnings). On his Michigan return, he only reports the Friday daily winnings of $2,000.

It is CRITICAL that gambling winnings and losses be properly documented. The following information should be maintained in a log:

1. the date and type of specific wager or wagering activity

Gambling Winnings And Losses On 1040 Tax Form

2. the name and address of the gambling establishment

Where To Report Gambling Winnings And Losses On 1040

3. the names of other persons present with the taxpayer at the gambling establishment

4. the amount won or lost

Gambling Winnings And Losses On 1040 Ez

If you need help with small business taxes,

sign up for a FREE tax analysis.

Buzzkill Disclaimer: This post contains general tax information that may or may not apply in your specific tax situation. Please consult a tax professional before relying on any information contained in this post.